Click to enlarge

DoD inventories and funding of UAS are expected to continue a gradual upward trend through 2015 and then trend downward in 2016 and beyond, although UAS experienced a full $1.3 billion (33.4%) reduction from fiscal year (FY) 2013 to PB2014 in combined research, development, test, and evaluation (RDT&E) and procurement funding. Outside DoD, UAS sector growth is predicted to continue to rise and was described as “the most dynamic growth sector of the world aerospace industry this decade.”

Within DoD, RDT&E funding is planned to taper off over the next five years; and depot maintenance consolidation efforts underway are expected to reduce operation and maintenance costs (O&M).

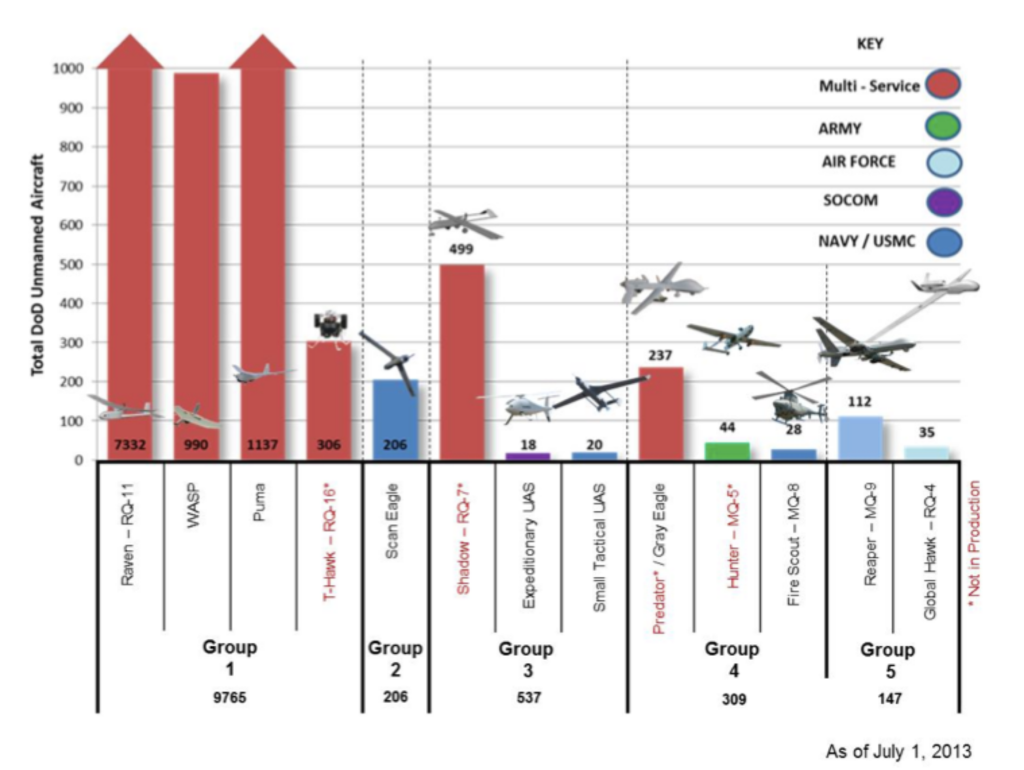

However, considering current inventory levels, overall funding demonstrates a continued commitment to invest in UAS performing predominately ISR missions. Thus, while one industry analysis and forecasting group estimates worldwide UAS spending will almost double over the next 10 years to a total of $89 billion,8 a comparison of DoD funding plans versus industry predictions indicates DoD will not be the bulk user within that market. However, DoD does intend to be the most innovative user. From a strategic planning perspective, UAS have grown to a sizeable fleet providing a variety of capabilities that DoD will need to maintain over the near term. [See figure above].

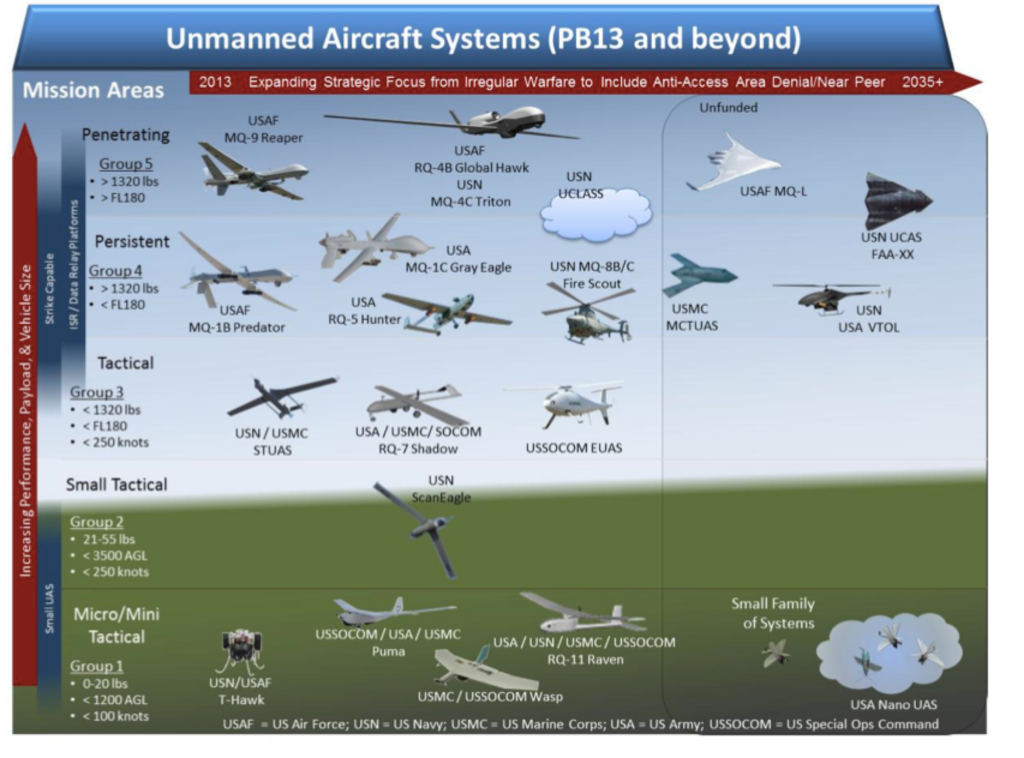

Looking toward the future, modernisation of current capabilities will dominate, and limited development of new capabilities will likely focus on smaller numbers of higher end platforms capable of operating in more contested air environments. With fewer new systems in development and many future projects being deferred, the planning outlook toward future systems is much more conservative. [See Figure below].

Click to enlarge

Click to enlarge

Source: DoD