Israeli exports of unmanned aircraft over the last eight years totaled 4.62 billion USD and are expected to grow at 5-10% per year until 2020, according to a new study release by the International consulting firm of Frost & Sullivan.

Israeli exports of unmanned aircraft over the last eight years totaled 4.62 billion USD and are expected to grow at 5-10% per year until 2020, according to a new study release by the International consulting firm of Frost & Sullivan.

Israel is the world’s largest exporter of unmanned aircraft systems in terms of volume, variety of systems, as well as the number of countries to which these items were sold over the past decade.

This sum includes products, services, and licensing to produce these products in other countries. The figure accounts for nearly 10% of the total volume of Israel’s defence export, and this figure is expected to rise in coming years. The main reason for this increase, estimated by Frost & Sullivan, is a cessation of reliance on the U.S. Department of Defense as major purchasers have turned to other markets, especially supported by Israel’s entrepreneurial spirit.

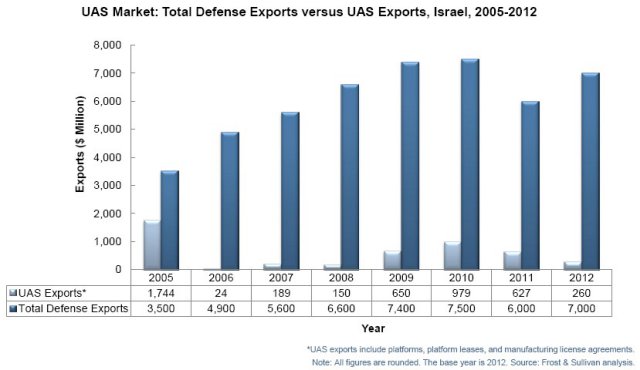

However, it is difficult for Israel’s industries to repeat its achievement of 2005, when Israeli exports of unmanned aircraft totaled approximately $ 1.7 billion. Intensive and targeted activities of the Ministries of Defense and the Israeli Foreign Ministry in introducing new trade laws have strengthened their ability to secure control over exports. This has affected exports significantly.

During the years exports failed to pass one billion dollars per year, the peak year was in 2010, when Israeli companies’ exports in this field were approximately 979 million USD. In 2011 the amount dropped to about 627 million and 2012 continued to decline and amounted to approximately $ 212 million.

The average volume of Israeli exports in the field of security between 2005 and 2012 was approximately $ 6.1 billion per year, of which the average annual exports of products relating to unmanned aircraft totaled approximately 578 million USD. This amount does not include a transaction of approximately 958 million USD that was signed with India in 2012, for the upgrade of unmanned aircraft. If combined with the other figures this transaction would have increased the average annual export volume by about $ 100 million USD.

Eran Flumin, Frost & Sullivan CEO in Israel, stated that “the scope of the entire Israeli defence exports is likely to grow, while Israeli companies continue to sign strategic partnerships with foreign companies while investing in aggressive marketing in markets where demand for unmanned aerial systems continues to grow, such as Africa, Asia – Pacific and South America”.

The company expects that growth in demand for such aircraft, when combined with continued delays in the easing of the U.S. government’s terms of policy to its defence exports (ITAR) of local companies, will enable Israeli companies to increase their exports by 5% to 10% by 2020.

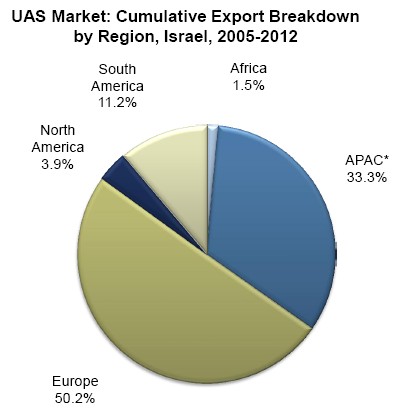

Most Israeli exports in this sector for the years 2005-2012 were intended for Europe, accounting for about 50.2% of total exports. More than half of that volume, about 1.25 billion relates to the ‘Watchkeeper’ project associated with the British Army, involving a joint venture between Israeli Elbit and British THALES. Approximately 33.3% of the total exports were intended for Asia-Pacific, while U.S. sales took a 3.9% share of the total exports.

Most Israeli exports in this sector for the years 2005-2012 were intended for Europe, accounting for about 50.2% of total exports. More than half of that volume, about 1.25 billion relates to the ‘Watchkeeper’ project associated with the British Army, involving a joint venture between Israeli Elbit and British THALES. Approximately 33.3% of the total exports were intended for Asia-Pacific, while U.S. sales took a 3.9% share of the total exports.

Flumin added that ” We identified and analyzed 20 Israeli companies in our study who are involved in this field, including Aeronautics Defense Systems, BlueBird Aero Systems, Elbit, Gilat Satellite Networks, IAI and more. The study also includes analysis of trends in the field and information on major transactions of Israeli companies in recent years “.

Source: IHLS