The “eyes in the sky” scenario outlined by the U.S. Pentagon is now beginning to make its way towards civil government use – a trend that will add significantly to commercial satellite bandwidth requirements over the long term, with UAS dominating the comms-on-the-move (COTM) segment until 2020.

As a key weapon in the U.S.’ counter-terrorism strategy, the U.S. Military plans to deploy air, surface, and undersea robotic vehicles, which will be an integral component of future capacity demand. However, civil agencies are increasing UAS requirements as well that could further boost bandwidth needs. For instance, the U.S. State Department has taken to operating a small fleet of unarmed surveillance drones in Iraq to protect American personnel and has indicated that it may expand its drone programme to other high-risk countries in the coming years. Closer to home, Customs and Border Protection (CBP) received its 9th Predator-B to be used for patrolling the U.S.-Mexico border.

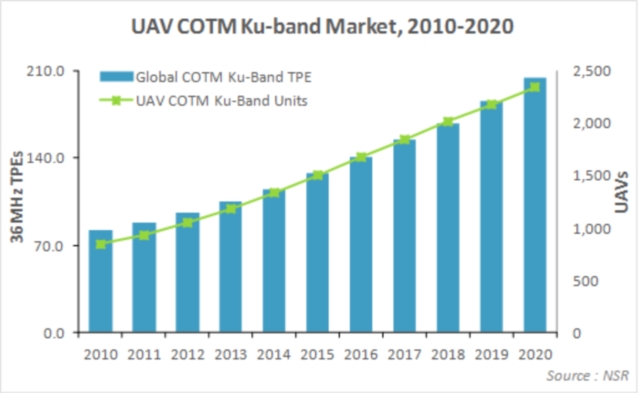

In NSR’s recent Government & Military Satellite Communications, 8th Edition report, bandwidth requirements by UAS are expected to be the highest of all the COTM platforms, despite a relatively low share of in-service units. With UAS missions on the rise and ISR instruments becoming more bandwidth intensive as well as the number of hours increasing per mission, UAS bandwidth demand can easily reach, if not breach, the 200 TPEs requirement for Ku-band forecasted by NSR by 2020.

Moreover, market offerings that are spun out of the DoD and spill over to civil agency use could potentially be offered to the commercial market as well. The FAA is already in the process of laying the groundwork for such use that could include utility companies for monitoring oil, gas, and water pipelines as well as farmers spraying crops, among other applications.

For the moment, however, UAS are not without controversy as missions have led to civilian casualties, are seen to be in violation of another nation’s sovereignty with the use of airspace, and pose legitimate risk to commercial traffic through the danger of collisions with commercial aircraft. These factors could certainly curtail use and thus restrain satellite capacity demand for UAS.

UAS have been and will likely remain controversial, particularly as usage becomes more prevalent in military, civil government and over time, enterprise markets. However, UAS are here to stay, and their growing presence should lead to more benefits when weighed with the risks. The key lies in:

- higher accuracy for tactical missions that avoid or minimize civilian casualties

- clear regulations and treaties that allow secure use of airspace internally and internationally

- technological improvements that improve safety

In NSR’s view, UAS demand is still in the early stages of the market cycle. Not if, but when safety features and key concerns have to be addressed, UAS market development should reach the next stage of market evolution, where the commercial satellite industry will stand to reap enormous benefits via higher levels of capacity demand.

Source: Northern Sky Research